FinanceLobby: Digitizing the Outdated Commercial Real Estate Lending with AI

Much of the global economy has always depended on commercial real estate (CRE) lending to help companies develop and acquire offices, buildings, and facilities for conducting the core of their operations. Trillions of dollars flow through CRE markets each year to enable commercial developments and allow businesses to grow to the best of their potential.

Unfortunately, the CRE lending market still runs on outdated processes in high-rate environments where credit is tightening by the month. Everything from limited transparency to inefficient deal matching has made the market slow to modernize itself, which hasn’t been good for the lenders or borrowers.

The good news is that this is about to change.

FinanceLobby: The Next Big FinTech Frontier in High-Rate Environments

The current state of the FinTech landscape is one where commercial and personal borrowers expect fast, seamless customer experiences when acquiring and managing their money. While personal banking may have caught up with the times, CRE lending continues to be held back by traditional broker-driven negotiations and manual spreadsheets.

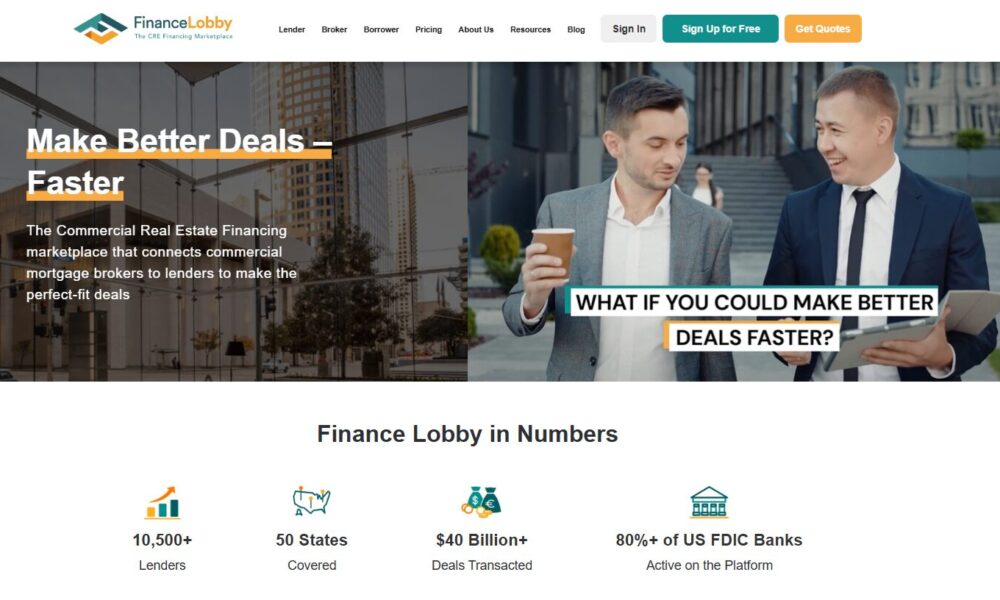

A Miami-based entrepreneur named Chaim Schwartz and his team have created the first AI-driven marketplace called FinanceLobby. It was built to modernize and digitize CRE lending, which is considered one of the most complex and underserved segments of FinTech. Since CRE lending has long been a market where lenders and borrowers frequently operate on outdated processes, FinanceLobby will bridge the gaps between them by matching CRE lenders and borrowers in real-time based on a few key deal parameters.

FinanceLobby uses an advanced AI system to apply data-driven deal-matching algorithms to connect borrowers with lenders using critical parameters, such as property type, loan size, speed, timing, and preferred interest rates. Borrowers will no longer need to spend weeks contacting different brokers to find the best deals and rates. Instead, they can utilize the power of the FinanceLobby platform to connect with the best lenders who are the most likely to approve their CRE lending needs.

Meanwhile, the lenders can benefit from using the FinanceLobby platform, too. They no longer need to search through countless loan applications from unqualified borrowers for projects that lenders don’t want to fund. Instead, the lenders will save time and effort by only receiving CRE lending requests from desirable borrowers who match their project funding requirements. It is an efficient way for lenders to confidently connect with borrowers who have the kinds of CRE projects that they are looking to fund.

How FinanceLobby Works

FinanceLobby operates as a real-time financial marketplace for CRE loans. It brings efficiency and transparency to a sector valued at trillions of dollars. The borrowers can post their CRE lending deals onto the platform and match up with over 10,000 lenders. Lenders can review all the deals in real time that match their deal parameters and requirements.

Here is how it works for borrowers:

1) The borrower spends no more than 5 minutes posting their deal on the platform.

2) The AI analyzes the parameters and criteria of the deal and matches them with verified lenders on the platform.

3) The lenders send credible offers directly to the inbox of the borrower.

4) The borrower looks through all the offers they received and chooses the best lender to work with without any middleman or delays.

5) The borrower and chosen lender connect and proceed with the deal.

Here is how it works for lenders:

1) The lender enters and posts their lending criteria into the platform

2) The lender receives qualifying deals in real time that match their criteria

3) The lender reviews the details of the deals and chooses the best ones.

4) The lender sends out their best offers to borrowers.

5) The lender waits for their offers to be accepted.

Key Features of FinanceLobby

Why should borrowers and lenders choose FinanceLobby over other digital platforms? Here are the key features that prove FinanceLobby is a dominant FinTech company:

- AI-Driven Matching – The AI system automatically filters deals and presents them to lenders based on the key parameters. Lenders will only see the best CRE borrower opportunities that align with their criteria.

- Fixed-Fee Loan Placement Model – FinanceLobby offers a $999 fixed-fee loan placement model to borrowers, regardless of the loan size. Borrowers will get matched to thousands of lenders instantly and receive unlimited deal posting for up to 6 months. This fixed fee is far less than traditional costs for CRE lending deal-matching services.

- Fast and Efficient – The FinanceLobby is faster, more efficient, and more effective than traditional brokerage models. It eliminates the lengthy preapproval processes and manual evaluation of CRE lending deals. Borrowers can seek CRE loan approval faster, while lenders can acquire commercial clients more quickly.

- High Deal Approval Rate – Between 40% and 50% of all posted deals made on the platform end up receiving accepted quotes from lenders. Compare this to the over (70% rejection rate) for residential loans in traditional channels, and you can see why FinanceLobby is the dominant FinTech startup in the CRE lending industry.

- More Transparency and Discoverability – The FinanceLobby platform connects borrowers with lenders they wouldn’t have otherwise had access to in traditional circles. Complete transparency about the deals, borrowers, and lenders is maintained to satisfy all stakeholders involved.

FinanceLobby has already been responsible for more than $40 billion on CRE deals, with over $1.2 billion in active deal flow per month. With sponsors in every major CRE market of the United States, borrowers will no longer feel alone when searching for the right lenders to finance their CRE projects.

Conclusion

FinanceLobby is an innovative FinTech startup poised to revolutionize the commercial mortgage brokerage industry. It eliminates traditional, expensive brokerage fees for borrowers by connecting them directly to lenders and vice versa. Thanks to the innovation of modern AI technology, FinanceLobby uses intelligence and specific data parameters to quickly match lenders and borrowers at the highest success rates ever.

Visit the FinanceLobby to learn more about the revolutionary new AI-driven CRE financing marketplace.

Source: FinanceLobby: Digitizing the Outdated Commercial Real Estate Lending with AI